Stable coin landscape in 2025

16 min read

We have written about stable coins a lot. Stable coins continue to gain momentum in year 2025.

The stablecoin market in April 2025 stands as a significant and rapidly evolving sector within the broader cryptocurrency ecosystem. With a total market capitalization exceeding $200 billion, these digital assets, designed to maintain a stable value relative to traditional currencies or other benchmarks, have become crucial tools for various applications, ranging from decentralized finance (DeFi) to cross-border payments. Dominant players like Tether (USDT) and USD Coin (USDC) continue to command a substantial market share, while newer entrants are beginning to gain traction. Regulatory developments across the globe are shaping the operational landscape for stablecoins, with major frameworks like MiCA in the European Union and ongoing legislative efforts in the United States setting the stage for a more structured future. Technological advancements are further enhancing the utility and accessibility of stablecoins, driving their adoption across diverse sectors. While the outlook for stablecoins in 2025 is largely positive, the market still faces inherent risks and challenges related to peg stability, transparency, and illicit use, which require careful consideration.

Market Size and Dominant Players

The stablecoin market has demonstrated substantial growth and scale by April 2025. Analysis from PitchBook researchers in the first quarter of 2025 indicated a total market capitalization surpassing $200 billion, representing a significant 15% increase from the final quarter of 2024. This growth underscores the increasing recognition and utilization of stablecoins within the digital asset space. Data from Bastion in mid-March 2025 further suggested an expansion, with the total circulating supply exceeding $227 billion. This progression from the Q1 figure suggests a continuing upward trajectory into April. CoinGecko's data from late March 2025 reported an even higher market capitalization of $236.7 billion , potentially reflecting intra-month market fluctuations or differences in data aggregation. Similarly, a report from ESMA in early April 2025 estimated the combined size of the stablecoin market to be around EUR 210 billion, which translates to approximately $220 billion USD. The consistency of these reports, all indicating a market capitalization well over $200 billion, confirms the robust scale of the stablecoin market by April 2025. The observed growth from the end of 2024 into the first quarter of 2025 signifies a sustained expansion of this asset class.

The level of trading activity within the stablecoin market is also considerable. PitchBook's analysis highlighted that stablecoin transaction volumes reached $1.8 trillion in the first quarter of 2025 alone. This figure, when annualized, points to a substantial volume of value transfer occurring through stablecoins. Data from Visa on-chain analytics, although not specifically for April 2025, showed a total transaction volume of $2.7 trillion on the unadjusted basis and $679.4 billion after adjustments. The significant difference between these figures likely reflects the complexities of on-chain transactions, including internal smart contract movements and exchange rebalancing activities. Notably, the average daily trading volume for Tether (USDT) had risen significantly to $182 billion by early April 2025. This substantial daily volume for a single stablecoin underscores its pivotal role in the overall trading landscape. The sheer volume of transactions, particularly when compared to traditional payment processors like PayPal (whose annual processed volume was less than the Q1 stablecoin volume), indicates the increasing integration of stablecoins into the broader financial ecosystem.

The stablecoin market is dominated by a few key players. Tether (USDT) consistently ranks as the largest stablecoin by market capitalization. As of late March and early April 2025, its market cap was reported to be in the range of $143-$146 billion. This leading position can be attributed to its first-mover advantage and its widespread integration across numerous cryptocurrency exchanges globally. USD Coin (USDC) has firmly established itself as the second-largest stablecoin, with a market capitalization fluctuating between $53-$60 billion during the same period. USDC's emphasis on regulatory compliance and transparency has made it a preferred choice for institutional investors and businesses seeking a more regulated digital dollar. A notable development in 2025 has been the rapid emergence of Ethena USDe (USDe) as the third-largest stablecoin, boasting a market capitalization of approximately $5 billion. Its innovative approach as a "synthetic dollar" that generates yield for institutional investors has contributed to its swift ascent in the market rankings. Beyond these top three, other stablecoins such as Dai (DAI), First Digital USD (FDUSD), and PayPal USD (PYUSD) hold smaller but still significant market capitalizations. These stablecoins often cater to specific user preferences or use cases within the broader digital asset ecosystem. The combined market share of USDT and USDC remains substantial, estimated to be between 70% and 90% of the total stablecoin market. However, the rapid growth of USDe indicates a potential shift in market dynamics, suggesting that alternative stablecoin models are beginning to gain traction and attract significant capital.

The Evolving Regulatory Landscape

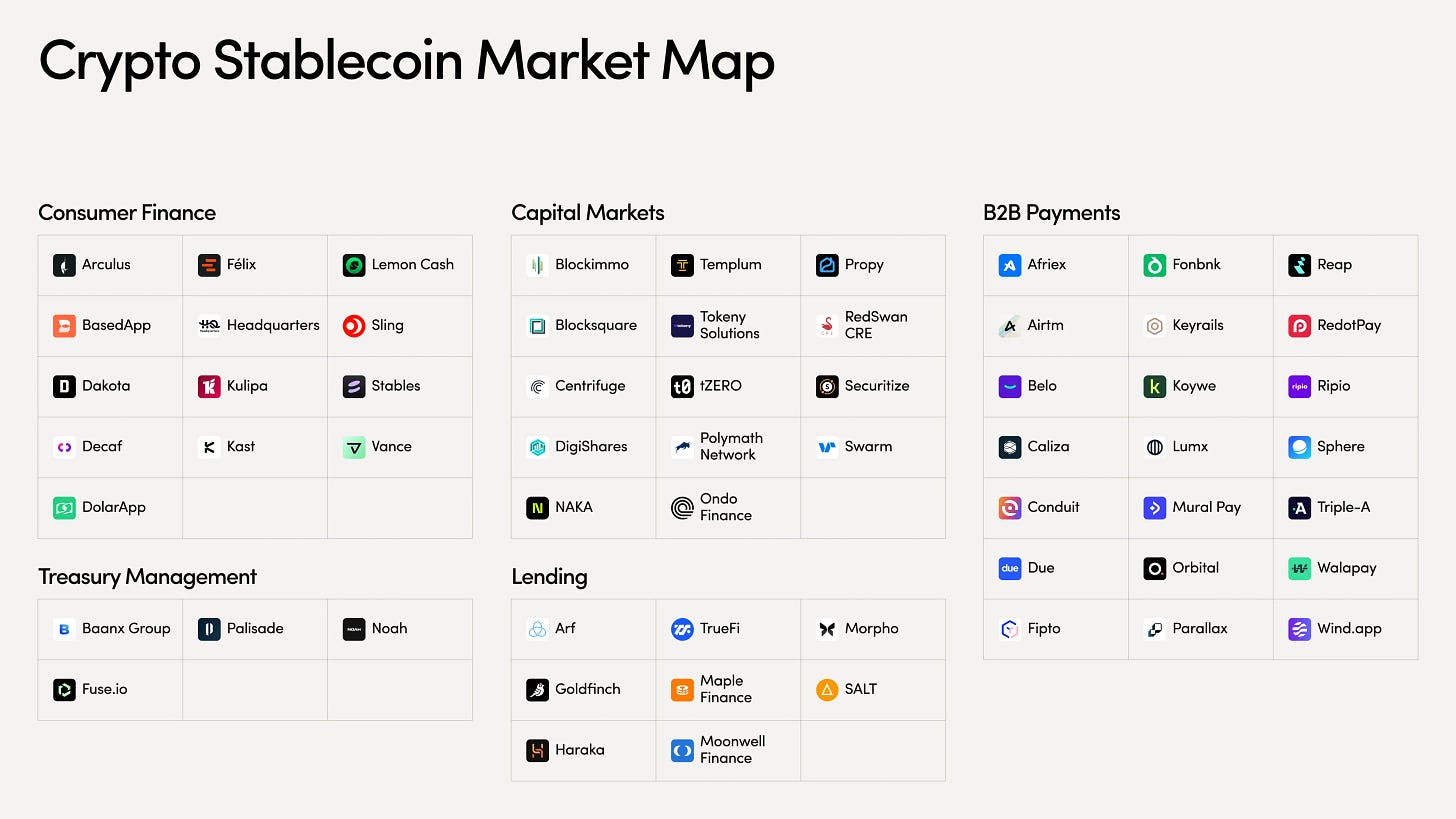

Image Source : https://linas.substack.com/p/stableslist

The regulatory landscape for stablecoins has continued to evolve significantly by April 2025, with major developments occurring across different regions.

In the European Union (EU), the landmark Markets in Crypto-Assets (MiCA) regulation, which came into full effect in December 2024, has established a unified and stringent regulatory framework for stablecoins across its 27 member states. MiCA mandates that stablecoin issuers must maintain reserves of liquid assets on a 1:1 basis, segregate customer funds, and obtain authorization as electronic money institutions (EMIs). A key aspect of MiCA is its effective ban on algorithmic stablecoins , reflecting lessons learned from past market instability. The implementation of MiCA has already had a tangible impact, leading to the delisting of prominent non-compliant stablecoins, including Tether (USDT), from major EU exchanges by the end of March 2025. Conversely, stablecoins deemed compliant with MiCA, such as USD Coin (USDC) and Eurite (EURI), remain available for trading and use within the EU. This comprehensive regulatory approach by the EU signifies a strong commitment to enhancing consumer protection and ensuring the financial stability of the stablecoin market within its jurisdiction. The proactive stance taken by the EU with MiCA could potentially serve as a blueprint for other regions grappling with stablecoin regulation.

The United Kingdom (UK) is also actively progressing towards establishing a clear regulatory framework for stablecoins, particularly those intended for use as payment instruments. The Financial Conduct Authority (FCA) released a 'crypto roadmap' in November 2024, indicating that a consultation paper specifically addressing stablecoins would be forthcoming in the first half of 2025. The UK government has also stated its intention to legislate that fiat-backed stablecoins must be fully backed by reserves of fiat currency. These developments suggest that the UK is adopting a cautious yet progressive approach to stablecoin regulation, focusing on ensuring stability and consumer confidence in digital payment methods. The alignment with the EU's emphasis on fiat backing for payment-focused stablecoins indicates a potential convergence in regulatory thinking across major European economies.

In Asia, the regulatory landscape for stablecoins presents a more diverse picture. Singapore has already implemented regulations under its Payment Services Act, with updated rules taking effect in early April 2025. These rules categorize stablecoin issuers and service providers as "digital payment token" (DPT) providers. Furthermore, specific regulations for stablecoins pegged to single currencies were finalized in August 2023, mandating licensing for issuers with a circulating supply exceeding S$5 million. Hong Kong has also expressed its ambition to establish a stablecoin regulatory regime in 2024 or 2025, aiming to position itself as a welcoming hub for regulated stablecoin activities and compete with Singapore in attracting crypto businesses. In contrast, Thailand has adopted a more flexible approach, approving the domestic trading of USDT (Tether) in March 2025 within its existing digital asset regulations. This varied regulatory landscape across Asia reflects different priorities and risk appetites concerning the adoption and oversight of stablecoins in the region.

The United States (US) has witnessed significant momentum building towards the creation of a comprehensive federal regulatory framework for payment stablecoins under the current administration. President Trump's executive order in January 2025 further underscored the priority of this issue. Several bipartisan bills have been under consideration in Congress, most notably the Guiding and Establishing National Innovation for US Stablecoins Act of 2025 (GENIUS Act) and the Stablecoin Transparency and Accountability for a Better Ledger Economy Act of 2025 (STABLE Act). The GENIUS Act, introduced in the Senate in February 2025, aims to regulate payment stablecoins by establishing standards for reserves, redemption rights, issuer licensing, and oversight and has successfully passed the Senate Banking Committee. Similarly, the STABLE Act, introduced in the House in March 2025, seeks to create a framework for dollar-denominated payment stablecoins, emphasizing transparency and accountability and has been ordered to be reported by the House Financial Services Committee in April 2025. Common elements in these bills include the requirement for one-to-one reserve backing, restrictions on the types of eligible reserve assets, and mandates for regular audits. Furthermore, both bills seek to clarify that payment stablecoins should not be classified as securities under federal law. The progress of this legislation in both chambers of Congress suggests a strong likelihood of a comprehensive federal regulatory framework for stablecoins being enacted in the US during 2025.

Adding to the US regulatory landscape, the SEC's Division of Corporation Finance issued a statement on April 4, 2025, clarifying its position on certain "Covered Stablecoins". The statement specifies that USD-pegged stablecoins that are backed 1:1 by low-risk, liquid assets and are designed for use in commerce and payments do not involve the offer and sale of securities. This clarification provides a degree of regulatory certainty for issuers of stablecoins meeting these criteria, potentially facilitating their use as payment instruments without necessitating SEC registration. However, this guidance explicitly excludes algorithmic stablecoins and those that offer yield or interest.

The evolving regulatory landscape is having a multifaceted impact on the stablecoin market. Increased regulatory scrutiny and the implementation of frameworks like MiCA in the EU are leading to higher compliance costs for major issuers. There is also a potential risk that overly stringent regulations could stifle innovation and make it challenging for smaller issuers to compete, possibly leading to market consolidation. On the other hand, the clarity provided by regulatory frameworks is expected to boost institutional investor confidence, encouraging greater adoption of stablecoins by traditional financial institutions. The anticipated passage of stablecoin legislation in the US could position US issuers favorably in the global market , while the EU's MiCA regulation might create barriers for non-EU issuers of USD-denominated stablecoins seeking to operate within the European market.

Innovation and Emerging Trends

The stablecoin market in 2025 continues to be a hotbed of innovation, with several new projects and technological advancements gaining traction.

Among the new stablecoin projects is Pi Protocol, which aims to differentiate itself by being backed by yield-bearing real-world assets, such as bonds. This project is expected to launch on the Ethereum and Solana blockchains in the second half of 2025, representing a move towards incorporating traditional financial instruments to generate returns for stablecoin holders. Another notable project is World Liberty Financial USD1, a new stablecoin pegged to the US dollar that has the backing of President Donald Trump and his family. The reserves for USD1 will be custodied by BitGo, a prominent digital asset custodian. This project highlights the increasing interest in stablecoins from political figures and their potential integration into specific ecosystems. Ripple's stablecoin offering, RLUSD, announced its availability on global exchanges in December 2024, signaling the entry of established fintech companies into the stablecoin arena. The Wyoming Stable Token (WYST), an initiative by the Wyoming Stable Token Commission, entered its testing phase across multiple blockchain networks in March 2025. This project aims to be the first fiat-backed and fully reserved stable token issued by a public entity in the United States, representing a novel approach to government involvement in the stablecoin market. Furthermore, Avit Stablecoin was launched in March 2025 by Custodial Bank and Vantage Bank, marking it as "America's first bank-issued stablecoin on a permissionless blockchain," specifically Ethereum. This development signifies the increasing integration of traditional banking with blockchain technology and the potential for banks to issue their own stablecoins. These new projects demonstrate a continued drive for innovation within the stablecoin space, with a particular focus on real-world asset backing and navigating the evolving regulatory landscape.

Technological advancements are also playing a crucial role in shaping the stablecoin market. There is a significant emphasis on developing interoperability solutions that would allow for the seamless transfer and utilization of stablecoins across various blockchain networks. This is essential for enhancing the usability and reach of stablecoins across different decentralized applications and ecosystems. Another key trend is the increasing focus on real-world asset tokenization as a mechanism for backing stablecoins. By backing stablecoins with tangible assets such as gold, commodities, and U.S. Treasuries, issuers aim to enhance their stability and potentially link their value to real-world economic activity. Circle, a major issuer of USDC, is actively developing several technological enhancements, including Modular Smart Contract Accounts for advanced wallet functionality, Circle Paymaster to enable gasless transactions, and CCTP V2 for facilitating more efficient cross-chain transfers of USDC. These advancements are geared towards improving the user experience and reducing the costs associated with stablecoin transactions. Additionally, Visa's Tokenized Asset Platform (VTAP) is playing a significant role by enabling banks to issue and manage fiat-backed tokens and stablecoins, effectively bridging the gap between traditional financial infrastructure and blockchain technology. These technological advancements are crucial for unlocking the mainstream adoption of stablecoins by making them more user-friendly, efficient, and connected to the traditional financial system.

While facing regulatory scrutiny and having experienced significant failures in the past, innovation in algorithmic stablecoins continues in 2025. Examples of algorithmic stablecoins that remain active include Frax (FRAX), which operates on a fractional reserve system, and Ampleforth (AMPL), known for its unique rebasing mechanism that adjusts token supply based on price fluctuations. Terra Classic (USTC) is also attempting a comeback, focusing on enhanced governance and updated stabilization protocols. Furthermore, there is a growing interest in developing hybrid models that blend fiat collateral with algorithmic adjustments and the efficiencies of blockchain technology, aiming to achieve greater stability than purely algorithmic models. Despite these ongoing efforts, the widespread adoption of algorithmic stablecoins for mainstream business and everyday use remains uncertain due to persistent concerns about their reliability and the potential for depegging events.

Over-collateralized stablecoins continue to primarily serve a niche within the cryptocurrency market, particularly within the decentralized finance (DeFi) ecosystem. These stablecoins, such as Aave's GHO and Ethena's USDe (which also incorporates some algorithmic features), are backed by other cryptocurrencies, requiring the value of the collateral to exceed the value of the issued stablecoins to maintain their peg. This over-collateralization is necessary to buffer against the price volatility inherent in the backing crypto assets. As of early 2025, the combined market capitalization of all crypto-backed stablecoins was approximately $19 billion. While these stablecoins provide a decentralized alternative for various DeFi applications, their capital inefficiency due to the over-collateralization requirement makes them less practical for broader use in everyday transactions or cross-border payments.

The emergence and potential impact of Central Bank Digital Currencies (CBDCs) also remain a significant factor influencing the stablecoin landscape in 2025. In a notable policy decision, President Trump issued an executive order in January 2025 explicitly opposing the establishment, issuance, circulation, and use of a CBDC within the United States. This stance reflects concerns about potential threats to financial stability, individual privacy, and the sovereignty of the US, and it signals a clear preference for private sector-led innovation in the digital currency space, particularly through dollar-backed stablecoins. However, on a global scale, over 130 jurisdictions are actively exploring CBDCs at various stages of development, with some countries, including the Bahamas, Jamaica, and Nigeria, having already launched their own central bank digital currencies. This indicates a widespread international interest in government-backed digital forms of currency. The US policy aims to leverage the potential of dollar-backed stablecoins to ensure the continued international dominance of the US dollar in an increasingly digital financial world. This contrasts with the approach taken by some other major economies, such as the EU, where policymakers view CBDCs (like the digital euro and digital pound) as being more aligned with their goals of maintaining financial stability compared to cryptocurrencies and private stablecoins. While some analysts suggest that a US CBDC could potentially compete with privately issued stablecoins in the future , the current US administration's strong stance against a CBDC suggests a regulatory environment more favorable to the growth and adoption of private stablecoins within its jurisdiction. The divergent policy approaches between major global economies regarding CBDCs and stablecoins will likely continue to shape the future of digital currencies worldwide.

Sector Adoption and Use Cases

Stablecoins have witnessed increasing adoption across various sectors of the financial landscape by April 2025.

Decentralized Finance (DeFi) remains a cornerstone for stablecoin utilization. These digital assets are integral to the functioning of numerous DeFi protocols, serving as the primary medium of exchange and collateral for liquidity pools on decentralized exchanges (DEXs), lending and borrowing platforms, and yield farming initiatives. The price stability offered by stablecoins is crucial for the smooth operation of these decentralized financial applications. They facilitate seamless trading of other, more volatile crypto assets on DEXs and provide a relatively stable store of value within the often-fluctuating DeFi ecosystem. Notably, USD Coin (USDC) is increasingly recognized as a key on-ramp for institutional investors seeking exposure to the opportunities presented by DeFi, owing to its focus on regulatory compliance and transparency. Overall usage data indicates that stablecoin activity within the DeFi sector remains at historically high levels, underscoring their continued and critical importance to this evolving financial paradigm.

The use of stablecoins in cross-border payments has also experienced significant growth and adoption. Stablecoins offer a compelling alternative to traditional methods of international money transfer by providing faster transaction speeds, significantly lower fees, and enhanced efficiency. By circumventing traditional intermediaries such as correspondent banks, stablecoins can drastically reduce both the cost and the time required for cross-border settlements. In 2024, the total transfer volume of stablecoins even surpassed the combined transaction volumes of major global payment networks like Visa and Mastercard, indicating their growing prominence in facilitating international value exchange. Furthermore, major corporations and financial institutions, including Visa, PayPal, Stripe, and Revolut, are actively integrating stablecoins into their payment infrastructures to streamline cross-border payment processes.

The adoption of stablecoins for everyday transactions is also showing promising signs of growth in 2025. Stablecoins are increasingly being integrated into digital wallets and linked to existing payment systems, making them more accessible for consumers to use for everyday purchases, both online and in physical stores. Merchant acceptance is also on the rise, with major payment processors like PayPal and Stripe beginning to enable merchants to accept crypto assets, including stablecoins, as a form of payment. Stripe's acquisition of the stablecoin platform Bridge in 2024 was a significant step towards facilitating stablecoin settlements within its vast payment network. Moreover, PayPal's launch of its own stablecoin, PYUSD, is specifically aimed at facilitating faster and more cost-effective international transfers for both consumers and businesses, but it also holds the potential for broader use in everyday commercial transactions. While the adoption of stablecoins for everyday transactions is still in its early stages compared to their use in DeFi and cross-border payments, these developments suggest a growing trend towards their integration into mainstream commerce.

Conclusion

In April 2025, the stablecoin market stands as a robust and increasingly influential segment within the cryptocurrency landscape, with a total market capitalization exceeding $200 billion. Dominant stablecoins like USDT and USDC continue to lead the way, but the emergence of new players and innovative models indicates a market ripe for further evolution. Regulatory developments worldwide, particularly the comprehensive MiCA framework in the EU and the promising legislative progress in the US, are laying the groundwork for a more structured and regulated future for stablecoins. Technological advancements are enhancing their utility and accessibility, driving adoption across key sectors such as DeFi, cross-border payments, and everyday transactions. While the expert outlook for the stablecoin market in 2025 is largely positive, fueled by regulatory clarity and increasing adoption, the market still faces significant risks and challenges related to peg stability, transparency, and illicit use. These issues will require continued attention and robust solutions to ensure the long-term health and trustworthiness of stablecoins. Ultimately, the state of stablecoins in 2025 reflects their growing importance as a bridge between traditional finance and the digital asset world, with the potential to redefine how value is transferred and managed globally, provided that the inherent risks are carefully navigated and the regulatory landscape continues to mature.